What are the Narratives Driving the Crypto Market? 2024 Narratives and How to Track Them Going Forward

2024.08.28

- Market Research

Writer

In the world of Web3, “narratives” have become crucial elements that move the market.

This article will explain the concept of narratives and introduce the major crypto narratives that gained attention in the first half of 2024.

Please read on to the end.

Additionally, Pacific Meta distributes a newsletter for companies engaged in Web3 businesses.

Based on the know-how cultivated through supporting over 100 projects, we deliver the latest information on the Web3 industry, case studies, and other useful information for problem-solving.

⇒ Subscribe to Pacific Meta’s newsletter

What is a Narrative?

While “narrative” directly translates to “story,” its interpretation in the Web3 context is slightly different. In crypto markets, a narrative refers to a phenomenon where a specific theme or trend gains widespread attention, leading to a surge in investment and speculation in related assets.

This concept is a crucial element in forming market trends. When a new narrative forms, it can trigger significant capital inflows and price fluctuations. For example, during the crypto bubble of 2021-2022, when new technologies and approaches like Solana and Avalanche (known as Ethereum killers) or NFTs emerged, related assets rapidly increased in value in the market. This is the influence of narratives. Capturing these narratives early and riding the wave is becoming important from a marketing perspective as well.

To effectively capture narratives, it’s crucial to observe market trends across a wide range and quickly catch up on which themes are attracting attention. In particular, by following what specialized information sources and early adopters are focusing on, you can detect signs of new narratives early. Trends in discussions on social media and forums are also important clues.

The key is not just to follow trends, but to understand the technical and contextual basis behind them and evaluate whether there is sustainable value. To become sensitive to narratives, it’s effective to conduct qualitative analysis in addition to quantitative data. For instance, while it’s important to observe increases in trading volume or transactions for specific themes, it’s also effective in understanding narratives to collect information when influential individuals or projects announce new claims or technologies, and analyze and consider their impact on the market.

Ultimately, marketing strategies using narratives are very much about timing, requiring the insight to quickly discern new trends and market changes, and judge when and what kind of viral content to create.

Major Crypto Narratives in the First Half of 2024

Let’s actually interpret the narratives of 2024. We’ll reference two reports from CoinGecko: the first quarter and second quarter reports of 2024.

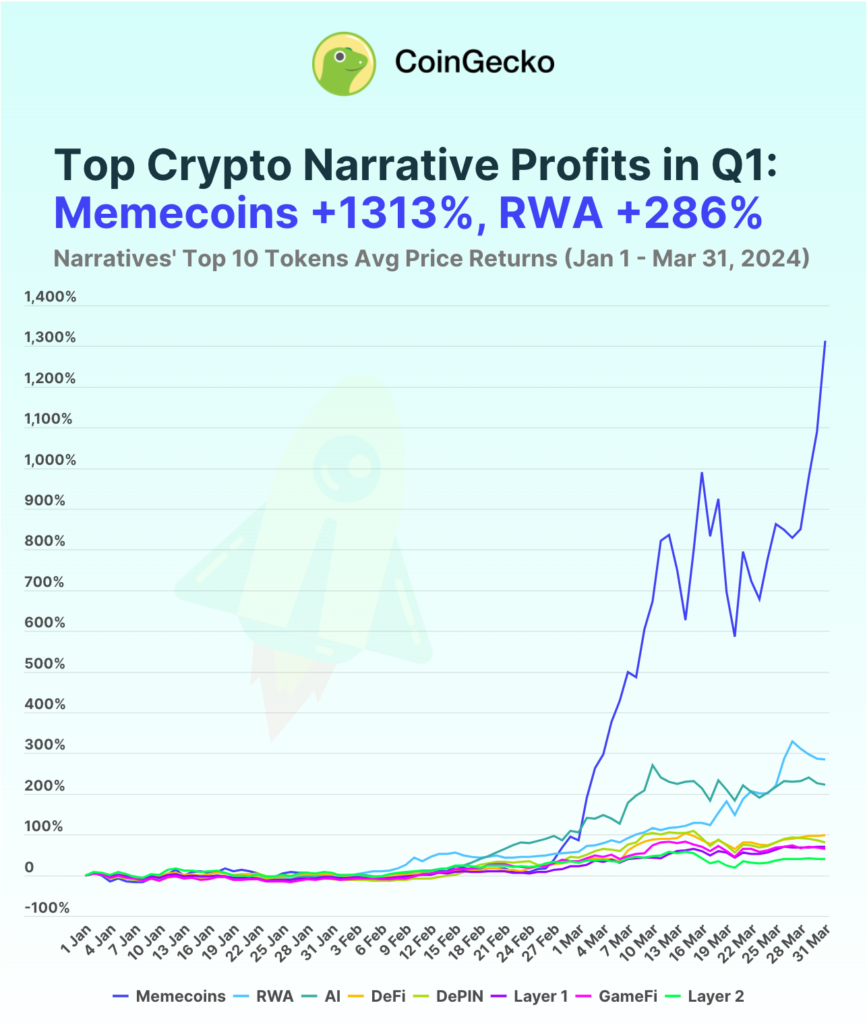

The first quarter 2024 report shows the average profit rate of the top 10 for each theme, indicating the market growth rate.As you can see, meme coins show overwhelming growth, while other themes are limited to average profit rates of 100% to 200%.

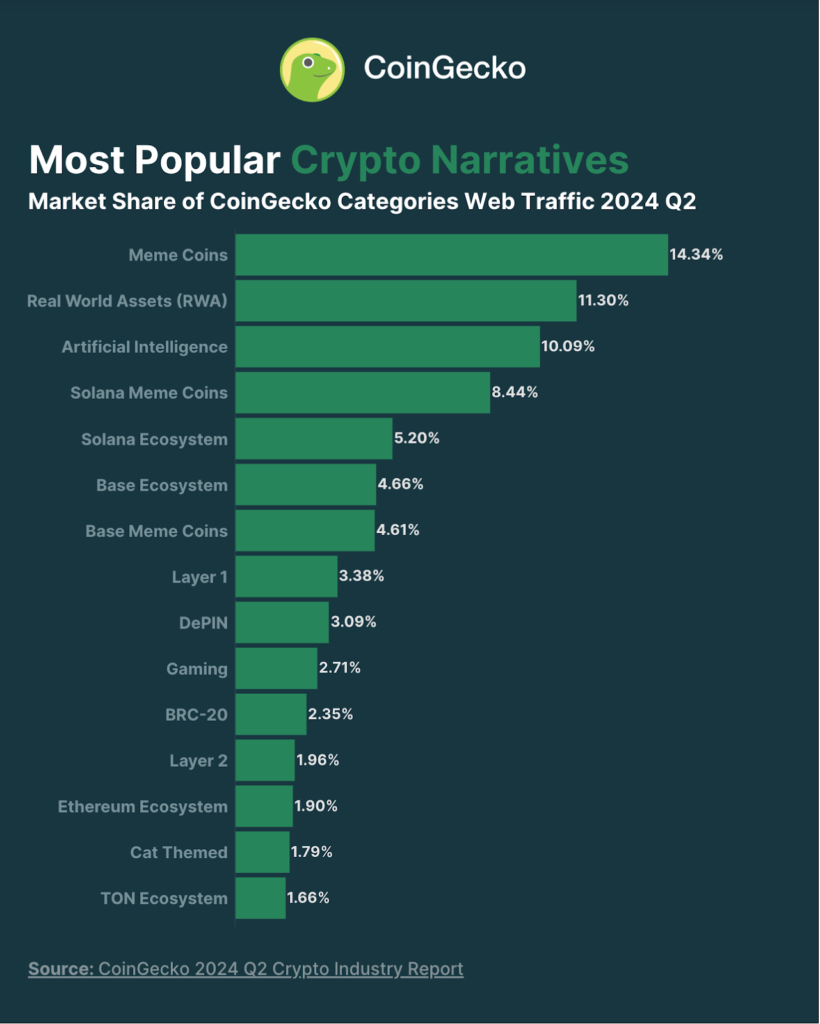

The second quarter 2024 report calculates the share of narratives based on the number of accesses to each category page on CoinGecko. Again, meme coins dominate in popularity here.

Notably, “Solana Meme Coins” ranking fourth also indicates the excitement around meme coins on Solana, as reported in various news outlets.

Below, we’ve highlighted four narratives that were particularly talked about in 2024. We’ve outlined their overview and reviews.

Meme Coins

Overview

Meme coins are a type of cryptocurrency created based on internet memes or cultural phenomena. The most famous example is Dogecoin, which Elon Musk has frequently mentioned on X (formerly Twitter).

Originally created as a joke, it rapidly increased in market value due to support from a large internet community.

Meme coins are often used for new forms of marketing strategies or social media movements, but they’re considered a high-risk investment theme as their source of value is ambiguous.

Review

The excitement around meme coins in 2024 partly inherits the NFT boom seen in 2021 and 2022. The NFT market gained attention for investment opportunities in digital art, but low liquidity became a major challenge. This led many investors to seek other high-liquidity assets, and meme coins seem to have emerged as an alternative.

Meme coins tend to see price increases due to their casual nature and community-driven characteristics, which enhance their viral potential on social media. Intentional price manipulation is also rampant, and there are aspects of Ponzi schemes, so caution is necessary when purchasing.

In the first quarter of 2024, meme coins emerged as the most profitable narrative among all themes, achieving an explosive return of 1312.6% across major tokens. Notably, many of the top 10 meme coins by market cap at the end of the quarter, such as BONK, BOME, and MEW, were launched on Solana. Solana is known for its high-speed processing and low costs.

Platforms like Solana are said to provide an optimal environment for bot trading due to their technical characteristics, attracting many botters. It can be predicted that high-frequency trading of meme coins, which are easy to profit from, is also booming as a speculative target.

Furthermore, the excitement around Pump.fun, a platform enabling the creation and trading of meme coins on Solana, cannot be ignored. It’s said that since its release in February 2024, Pump.fun has issued 418,900 tokens and generated a cumulative $6.9 million by May 5.

RWA

Overview

RWA (Real World Assets) refers to the integration of physical assets with blockchain technology. This theme enables the digitization of real-world assets such as real estate, financial products, and artworks into tokens that can be bought and sold on distributed ledgers. Tokenization of RWAs improves asset liquidity, ensures transparency, and provides unprecedented access to a wide range of investors. This is expected to enable more efficient transactions in traditional asset markets and new forms of fundraising.

Review

While tokenized investment products such as luxury goods and US Treasury bonds significantly expanded their market size during 2023, this growth pace seems to have slowed somewhat entering 2024. This is thought to be due to a lack of demand for financial products like tokenized real-world assets. Potential users of RWAs are likely to be mainly institutional investors and traditional financial institutions, but demand for RWAs is still limited as many countries lack proper legal frameworks or speculative environments.

However, the RWA narrative still emerged as the second most profitable in the cryptocurrency field, generating an attractive return of 285.6%. Projects leading this theme include Ondo Finance and Pendle. Initially, RWA temporarily took the top spot in early February but was overtaken by meme coins and AI narratives. However, it gradually regained momentum, surpassing the AI sector’s profit rate by the end of March.

AI

Overview

The AI sector in Web3 fundamentally aims to utilize blockchain technology for artificial intelligence to improve data transparency, security, and efficiency. This theme seeks to improve a wide range of processes including storage, learning training, computing, and data analysis and prediction.

These technologies are expanding the possibilities for new forms of data sharing and application development based on transparency and decentralization. The integration of AI and blockchain is an attempt to create a new standard for digital transactions and applications while enhancing data accessibility while protecting privacy.

Review

The excitement in the AI sector in 2024 is showing momentum with the emergence of projects aiming to integrate Web3 and AI, as AI technology gains attention worldwide. There’s also an intersection with the DePIN narrative. DePIN aims to decentralize physical infrastructure, and the development in this field is closely related to the evolution of the AI sector.

AI (Artificial Intelligence) followed closely behind RWA in profitability, gaining a 222.0% return in the first quarter of this year. All major AI tokens recorded profits, with AIOZ Network leading at 480.2%, followed by Fetch.ai at 378.3%. Even OriginTrail, the lowest performer, recorded a notable return of 74.9% in the first quarter, indicating positive interest surrounding the AI narrative.

Even OriginTrail, the lowest performer, recorded a notable return of 74.9% in the first quarter, indicating positive interest surrounding the AI narrative.

DePIN

Overview

DePIN refers to networks that build and operate physical infrastructure in a decentralized manner using blockchain technology. This is categorized as a new approach that combines distributed ledger technology and incentive models to manage and operate physical infrastructure (such as communication networks, energy supply, data centers, etc.) efficiently and transparently.

Review

DePIN gained significant attention from late 2023 to the first half of 2024. Many projects are also related to the AI narrative, and as of March 10, 2024, the market value of DePIN-related tokens exceeded $31 billion.

DePIN is gaining popularity with projects that challenge the decentralization of internet infrastructure and the market dominance of centralized cloud services. DePIN stagnated in the first half of the first quarter but recovered later, ending the quarter with an 81.0% return.

Among the major DePIN tokens, notable performances were shown by Arweave with a staggering 292.5% profit, Livepeer recording a 133.7% increase, and Theta Network posting a 124.5% QTD. However, Helium underperformed, being the only large DePIN token to record a decline of 10.5% in the first quarter.

How to Evaluate the Expected Value of Narratives

Speculative Expectation Value

Speculative expectation value is an important element in forming Web3 trends. It plays a crucial role, especially in forming narratives at early stages. Projects with high speculative expectations tend to attract a large number of users and funds in a short period, garnering market attention.

This can be effective as a marketing strategy, particularly for promotion and hype generation, but it’s important to note that it doesn’t necessarily align with long-term value.

The question of when and to what extent speculative expectation value should be raised, or whether it’s appropriate to give users speculative expectation value in the first place, remains an unanswered question.

Fundraising Amount

The amount of funds raised by major projects in each theme suggests the continuity and scalability of their development. Large-scale fundraising can be evidence that a project has gained market trust, strengthening its narrative.

In marketing strategies, emphasizing successful fundraising rounds can encourage further trust and investment. As a trend, it’s not uncommon for projects to grow significantly within a few months to a year after fundraising news, so it’s possible to predict medium to long-term trends to some extent based on fundraising amounts.

Growth Potential

Growth potential is also one of the most important factors determining the sustainability of a narrative and its success in the market. Projects with high composability can be evaluated as having high growth potential. This can be measured by interoperability, API integration, modularity, and the richness of development kits and tools.

Projects with high growth potential are expected to grow in the long term and become attractive options for investors and market participants. It’s also important to consider factors such as network effects and market size.

Sharing of Vision and Philosophy

Sharing vision and philosophy is important for increasing user commitment. It helps build and strengthen relationships with the community by establishing long-term engagement with users.

By helping the community understand what global challenges the project is trying to solve and with what solutions, it becomes possible to form a highly sustainable community that goes beyond speculative activities. From a marketing perspective, the focus should be on communication with users and education.

What to Do to Capture Narratives a Few Months Ahead

Check Reports from VCs and Exchanges

Reports published by venture capital (VC) firms and cryptocurrency exchanges provide insights into the latest market trends and promising future projects. These reports, based on expert analysis and market data, are very effective in anticipating new narratives.

For example, they often detail areas of investor interest, technological innovations, or the impact of regulatory changes on the market. VCs are particularly likely to provide funding to projects with high awareness of emerging technologies and market challenges, which helps in identifying themes likely to see increased funding.

Check Projects That Have Raised Significant Funds

When browsing crypto news, you’ll often come across reports of emerging projects achieving large-scale fundraising. This is a sign of high expectations from investors. By tracking these projects, you can understand which technologies and ideas are attracting the flow of funds. Large fundraising often leads to massive airdrops or ecosystem grants in the future, which can be expected to increase speculative value and growth potential.

Check On-Chain Data Sites

Utilizing on-chain data sites can also be very effective. For beginners, using free sites like CoinMarketCap and CoinGecko and checking the market cap rankings daily can be an effective method. This allows you to understand which projects are attracting attention. Checking along with category-specific rankings makes it easier to grasp narratives. For advanced users, using paid on-chain data sites allows for more detailed analysis, such as trends in transaction volume and active users. Analyzing such data enables early trend detection and understanding of market movements.

Summary

This report introduced representative narratives leading the crypto market in 2024 and provided ideas for quickly catching up with narratives. In the current Web3, even excellent products can be difficult to get noticed if they fall outside the narrative.

As industry participants, while feeling challenges in this area, we cannot ignore this element of narrative for project success for the time being. Following the flow of narratives and discerning their changes has become an important perspective in marketing.

Additionally, Pacific Meta distributes a newsletter for companies engaged in Web3 business.

Based on the expertise gained from supporting over 100 projects, we deliver the latest information on the Web3 industry, case studies, and other helpful insights to address your challenges.

➡ Subscribe to Pacific Meta’s newsletter

*Disclaimer: This report should not be considered legal or financial advice.