【Event Report】Japan Stablecoin Summit 2025 ── The First Year of Stablecoins: Cross-Industry Collaboration Driving the Future of Finance

2025.10.29

- Offline Events

Writer

Pacific Meta

In September 2025, the “Japan Stablecoin Summit 2025” was held in Takanawa, Tokyo, bringing together leading experts to discuss the forefront of stablecoin implementation in Japan.

Jointly organized by Pacific Meta, TOKI FZCO, and Progmat, Inc., the event gathered major players from across sectors — including Japan’s Financial Services Agency (FSA), stablecoin issuer JPYC, Sumitomo Mitsui Banking Corporation (one of Japan’s three megabanks and among the world’s largest financial institutions), leading blockchain platforms, and major corporate enterprises. Over 300 attendees from Japan and abroad participated, making it one of the largest stablecoin-focused events in Asia and marking a major milestone for the industry.

Since the enforcement of Japan’s revised Payment Services Act in June 2023—positioning Japan as one of the first major economies with comprehensive stablecoin regulation—the legal groundwork for stablecoins has steadily advanced. In August 2025, JPYC became the first company in Japan to obtain FSA registration as an electronic payment instrument-type stablecoin issuer, marking a historic milestone. This achievement is particularly significant given Japan’s historically cautious approach to cryptocurrency regulation and the challenges of operating in a zero-interest rate environment that persisted until recently. The industry is now entering a phase where both “issuance” preparation and “implementation” discussions are progressing in parallel.

Through three comprehensive panel discussions, the summit explored practical regulatory considerations, specific use cases, and the strategic decision-making behind blockchain selection, revealing the roadmap for stablecoin adoption and expansion in Japan and beyond.

Contents

- Opening and Keynote Session by Pacific Meta

- Keynote Sessions by Sponsors

- Panel Discussion 1: "Stablecoin Issuers on Their Journey and the Road Ahead"

- Panel Discussion 2: "What will be useful with Stablecoin?"

- Panel Discussion 3: "What Are the Criteria for Selecting a Chain?"

- Closing Talk

“This transformation is irreversible — and there is no doubt that stablecoins are at its very center.”

Event Overview

- Event Title: Japan Stablecoin Summit 2025

- Date: September 10, 2025

- Venue: KDDI Corporation, Takanawa Office

- Organizers: Pacific Meta, TOKI FZCO, Progmat, Inc.

- Attendees: Approximately 300 (750+ registrations)

Opening and Keynote Session by Pacific Meta

── Pacific Meta as a “Testing Ground” for Real-World Stablecoin Implementation

Speakers:

- Shota Iwasaki, CEO, Pacific Meta

- Masakazu Hiza, Head of Financial Business Development, Pacific Meta </aside>

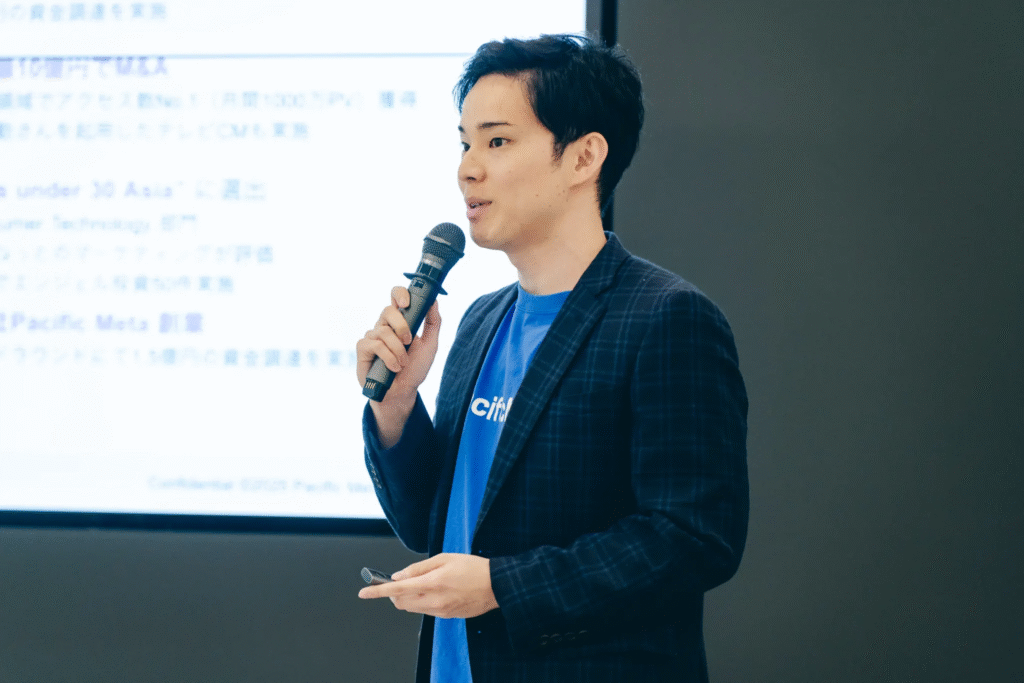

The opening keynote, delivered by CEO Shota Iwasaki and Financial Business Development Head Masakazu Hiza, showcased Pacific Meta’s unique position as both practitioner and evangelist in the stablecoin ecosystem.

Unlike typical consulting firms that only advise on blockchain implementation, Pacific Meta actively uses stablecoins in its own operations. The company utilizes stablecoins for managing corporate assets, achieving an annualized yield of approximately 9%. Moreover, stablecoins are integrated into day-to-day business operations, including payments to overseas partners and vendors, streamlining cross-border settlements and reducing transaction costs.

By positioning itself as a practical “testing ground” for blockchain-based financial systems, Pacific Meta demonstrates its commitment to solving real operational challenges while co-creating new standards across industries. This hands-on approach, combined with the company’s role as co-organizer alongside TOKI FZCO and Progmat—both notable infrastructure players in the space—underscores Pacific Meta’s leadership position in Japan’s emerging stablecoin ecosystem.

Keynote Sessions by Sponsors

Speakers:

- Noritaka Okabe, CEO, JPYC

- Ken Kashiwagi, Partnership / Strategic Initiatives Lead, Japan, Sui

- Maghnus Mareneck, Co-CEO, Cosmos / Interchain Labs

- Byung-Hee Kim, Head of Blockchain & Digital Asset Business, Shinhan Bank (Korea)* *Appearing on behalf of sponsor FairSquareLab </aside>

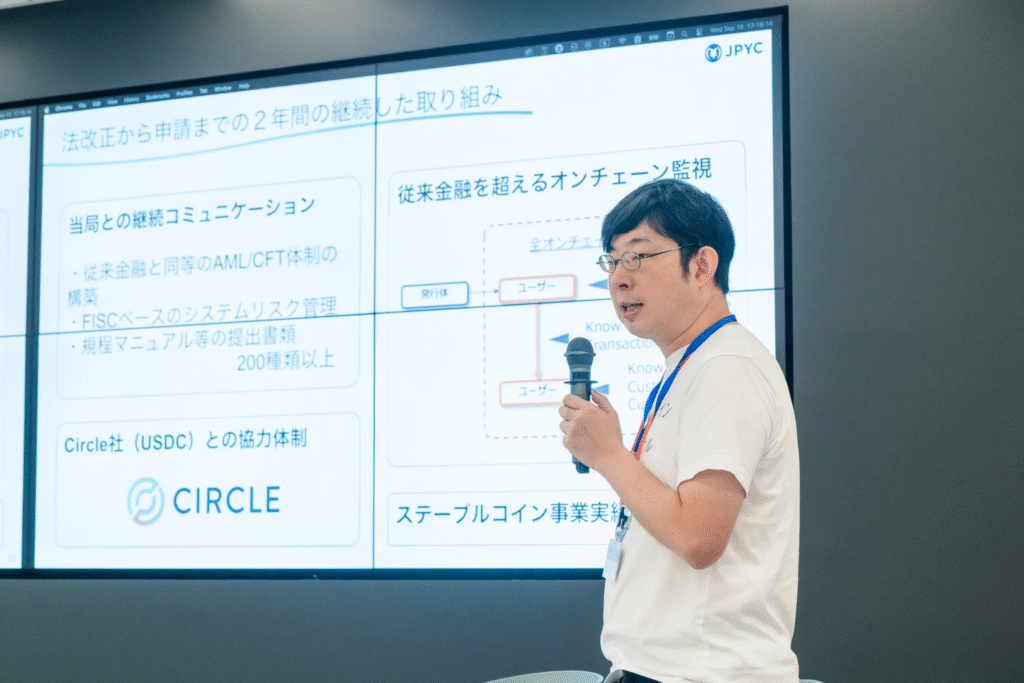

JPYC’s CEO Mr. Noritaka Okabe reflected on the company’s four-and-a-half-year journey since its founding in 2019 and outlined the roadmap toward the upcoming launch following FSA registration — marking Japan’s first licensed stablecoin issuance.

Mr. Ken Kashiwagi of Sui (Mysten Labs) highlighted Sui’s object-oriented architecture enabling high-speed, low-cost transactions, presenting potential use cases for stablecoins.

Mr. Maghnus Mareneck from Cosmos discussed the cross-chain interoperability enabled by IBC (Inter-Blockchain Communication) and its potential as financial infrastructure.

Mr. Byung-Hee Kim of Shinhan Bank shared insights from Korea’s CBDC pilot projects, emphasizing Japan–Korea collaboration in digital finance.

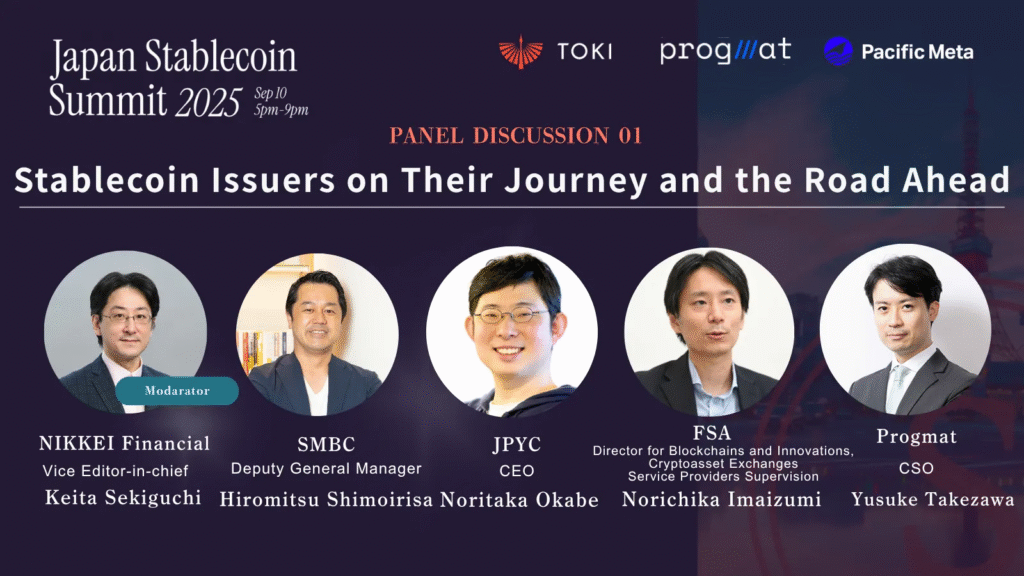

Panel Discussion 1: “Stablecoin Issuers on Their Journey and the Road Ahead”

Panelists:

- Keita Sekiguchi, Deputy Editor, The Nikkei (Moderator)

- Hiromitsu Shimoirisa, Senior Manager, Digital Strategy Division, Sumitomo Mitsui Banking Corporation (one of Japan’s three megabanks)

- Noritaka Okabe, CEO, JPYC

- Nobuchika Imaizumi, Counselor for Innovation, Crypto Assets and Blockchain, Financial Services Agency

- Yusuke Takezawa, CSO, Progmat

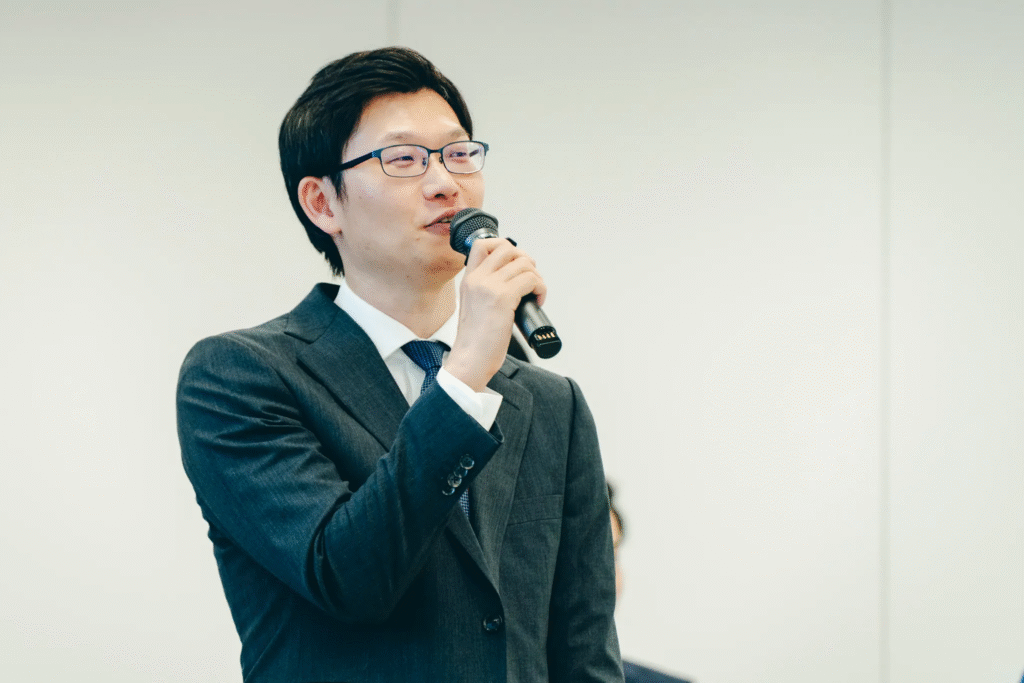

In the first session, speakers including JPYC’s Mr. Okabe—Japan’s first licensed stablecoin issuer—as well as representatives from Japan’s financial regulator, one of the country’s largest banks, and a leading blockchain infrastructure provider discussed the journey to issuance and their outlook going forward from their respective perspectives. This diverse panel represented the unprecedented collaboration between Japan’s traditional financial establishment and emerging blockchain innovators.

The Path to Japan’s First Licensed Stablecoin

Okabe reflected on the long and difficult journey toward obtaining approval for Japan’s first stablecoin issuance, saying,

“It was full of hurdles.”

He explained that the biggest challenge had been Japan’s zero interest rate environment.

“With zero interest rates, the business simply didn’t add up. Even as we strengthened our finances, we were constantly anxious about whether the model could really be sustainable.”

He went on to describe how the main source of revenue for a stablecoin business comes from the yield on short-term government bonds and similar reserve assets.

“If you issue a stablecoin under a zero-interest regime, your income is literally zero. Even if interest rates are 0.1%, issuing one trillion yen would only generate about one billion yen in returns — which is still quite tough.”

Okabe’s remarks illustrated just how critical the Bank of Japan’s recent shift in monetary policy has been for the feasibility of Japan’s stablecoin industry.

Shimoirisa of Sumitomo Mitsui Banking Corporation shared a similar view:

“When you look at stablecoins, you can see how Circle has studied the business model deeply — the monetization point is in asset management. But if you tried to replicate that in yen, it simply wouldn’t work. When I explained it internally, people would say, ‘So you’re just going to bleed red ink? The fact that we now live in a world with positive interest rates has finally made it possible for us to seriously consider this within the bank.”

From the Financial Services Agency (FSA), Mr. Imaizumi added the regulator’s perspective:

“In the registration review process, we must confirm that the business is sustainable. Interest rates are one factor, but not the only one. We take a comprehensive view — including the company’s governance structure, operational framework, and market risk management.”

Fund Transfer-Type vs. Trust-Type — Different Design Philosophies for Different Use Cases

Under the revised Payment Services Act, Japan’s Type II Funds Transfer Service imposes a daily remittance limit of 1 million yen.

Okabe acknowledged that “this inevitably restricts certain use cases,” but also struck a realistic tone about the path forward:

“There are some limitations, so regulatory easing may become necessary in the future. However, transfers between self-hosted wallets are not subject to any limit. For now, we’ll focus on expanding the use cases that are possible within the current framework, while preparing to broaden our scope as regulations evolve or as we obtain higher-level licenses.”

Takezawa of Progmat highlighted the importance of understanding the fundamental differences between the two models of stablecoins:

“Although the terminology may sound similar, the fund transfer-type model, like JPYC’s, and the trust-type model we’re developing at Progmat require entirely different ecosystems and operations. They must be designed as completely separate systems.”

He went on to explain that the fund transfer-type model is more suitable for retail payments, while the trust-type model excels in corporate settlements, interbank transactions, and cross-border trade.

“For banks and large corporations, the core value of stablecoins lies in their ability to enable instant settlement. This advantage becomes particularly significant in transactions that span countries or involve distant parties,” Takezawa explained.

The FSA as a Partner in Co-Creation — Exploring the Broader Potential of Stablecoins Beyond Issuance

Imaizumi from the Financial Services Agency (FSA) emphasized that the true value of stablecoins lies not in their issuance itself, but in the innovation that emerges around them.

Blockchain technology makes possible new types of transactions—such as Delivery versus Payment (DVP)—and services that combine financial settlement with the flow of commercial data. I believe we’ll see innovation not only within finance, but also in many adjacent industries.”

His remarks underscored that the FSA itself sees its role not merely as a regulator, but as a participant in fostering co-creation and innovation alongside industry players—a progressive stance that distinguishes Japan’s approach to digital asset regulation.

Panel Discussion 2: “What will be useful with Stablecoin?”

The second session explored, from the perspective of concrete use cases, the value that stablecoins can bring to society and the challenges that must be overcome for widespread adoption.

Panelists:

- Hiroyuki Yamaguchi, Deputy Director, International Business Planning Group, Shoko Chukin Bank (a major government-affiliated financial institution supporting Japanese SMEs)

- Shinsuke Sato, CEO, Slash Vision Labs

- Ken Kanetomo, Department Manager, Production Division, Konami Digital Entertainment (a globally recognized gaming company)

- Ken Kashiwagi, Partnership / Strategic Initiatives Lead, Japan, Sui

- Tatsuyuki Nakano, Senior Business Development Manager, Stablecoin Division, Datachain (Moderator)

Solving the Challenges of Cross-Border Transfers — “Instant and Direct Settlements”

Opening the discussion, Mr. Yamaguchi from Shoko Chukin Bank pointed out that differences in settlement systems and operating hours across countries and regions create a kind of “bucket relay” of funds, involving multiple intermediaries.

“With stablecoins, we can achieve instant and direct settlements, which could solve the issues of both speed and transaction costs,” he stated.

He also referred to the G20 target of ensuring that 75% of cross-border payments are credited within one hour by the end of 2027—a global initiative in which Japan, as a G7/G20 member, plays a key role—noting:

“At present, that goal seems difficult to achieve. That is precisely why, as a bank, we are seriously exploring the use of stablecoins.“

This statement underscores how Japan’s financial institutions are positioning stablecoins as critical infrastructure to meet international standards for payment efficiency.

The Future of Payments Beyond Cash Dependence

Speaking from the perspective of retail payments, Mr. Shinsuke Sato, CEO of Slash Vision Labs, drew on his experience living in Singapore to highlight that stablecoin payments are already becoming part of everyday life overseas.

When asked, “How is this different from PayPay — one of Japan’s leading mobile payment apps operated by PayPay Corporation, part of the SoftBank and LY Corporation group?” he gave a clear answer:

“I believe stablecoins represent the Internet of Money. Cash no longer needs to be at the center. In the future, stablecoins will occupy that central role, while cash will simply become one of many peripheral payment options.”

He further emphasized that realizing this vision will require two key drivers: the expansion of retail use cases and the deeper understanding and participation of traditional financial institutions.

From the gaming industry, Mr. Ken Kanetomo of Konami Digital Entertainment pointed out one of the key challenges in Web3 gaming:

“Transactions are currently biased toward crypto assets, and users have to go through the hassle of converting them back to yen.”

He continued,

“If users could receive payments in stablecoins, they would instantly have access to the same currency they use every day.In fact, they shouldn’t even have to think about whether their money is digital or not.”

At the same time, Kanetomo noted that multiple stablecoins are expected to be issued on different chains next year, underscoring the need for industry-wide standardization across sectors.

“To make this a reality, we must establish shared standards that transcend company and industry boundaries.”

Ensuring Stablecoins Are More Than a Passing Trend — Their Fundamental Value

Mr. Ken Kashiwagi from Sui emphasized that stablecoins should not be treated as a passing trend, but rather as a long-term means of payment and remittance that will play a lasting role in the digital economy.

From the gaming industry’s perspective, Mr. Ken Kanetomo of Konami Digital Entertainment highlighted one of the current challenges in Web3 gaming:

“Transactions are still heavily dependent on crypto assets, and users have to go through the hassle of converting them back into yen.”

He continued,

“If users could receive payments in stablecoins, they would instantly have access to the same currency they use in everyday life. In fact, users shouldn’t even have to think about whether their money is digital or not.”

Kanetomo stressed the importance of user experience, noting that multiple stablecoins are expected to be issued across different chains next year. He argued that the industry must create shared standards that transcend corporate and sector boundaries, aligning efforts across both technological and regulatory fronts.

“No one yet has a clear vision of when or through what mechanisms this will be achieved. That’s exactly why we need to define our goals together, beyond individual positions or organizations.”

His remarks served as a message to the entire industry — one that is now striving to build a new financial infrastructure from the ground up.

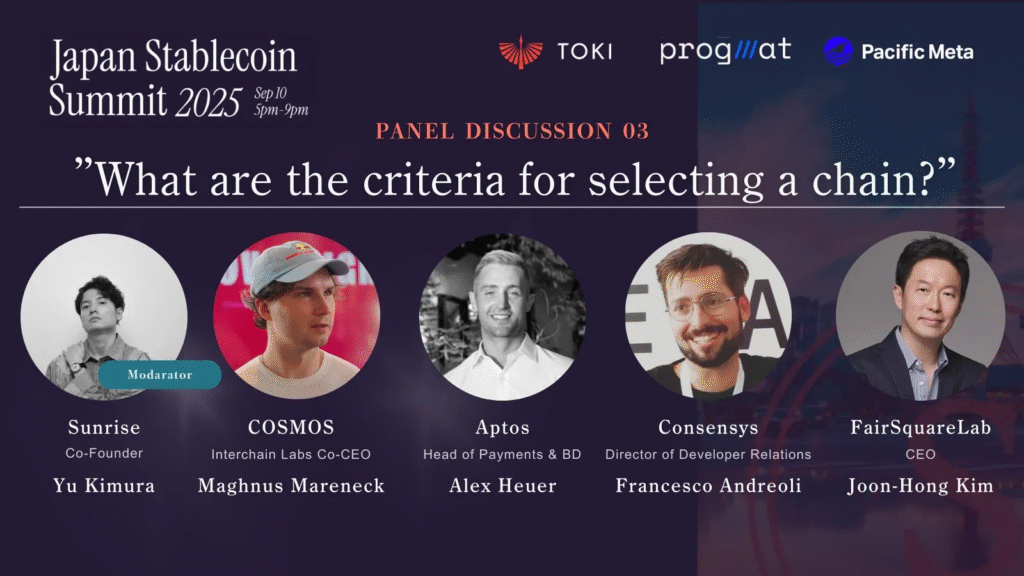

Panel Discussion 3: “What Are the Criteria for Selecting a Chain?”

The final session, conducted in English, focused on the criteria for blockchain selection, discussed from a global perspective—connecting Japan’s emerging market to international trends and technical considerations.

Panelists:

- Maghnus Mareneck, Co-CEO, Cosmos (Interchain Labs)

- Alex Heuer, Head of Payments & Business Development, Aptos

- Francesco Andreoli, Director of Developer Relations, Consensys

- Joon-Hong Kim, CEO, FairSquare Lab

- Yu Kimura, Co-Founder, Sunrise (Moderator)

Chain Selection Depends on the Use Case

Representing a Korean financial institution, Mr. Kim opened the discussion by outlining the key factors to consider when selecting a blockchain:

- Scalability

- Cross-chain interoperability

- Financial compliance (KYC and AML requirements)

- Ecosystem maturity

He emphasized,

“There is no single right answer. The optimal choice depends on which currencies you plan to support and what purpose your project serves.”

Responding to this, Mr. Heuer from Aptos explained,

“Aptos is optimized for payments, high-frequency transactions, and storage. For payment-focused use cases, it might make more sense than Ethereum.”

He noted that Aptos had been among the top-ranked platforms—alongside Solana—in the State of Wyoming’s RFP process for its state-backed stablecoin, evaluated across 70 blockchains on speed, security, decentralization, and track record.

At the same time, he stressed,

“If you’re developing a stablecoin specifically for the gaming sector, you should choose a chain with proven experience in that domain.”In short, “the right chain depends on the right use case.”

Balancing Developer Support and Regulatory Compliance

Mr. Andreoli of Consensys argued that stablecoins should be viewed not merely as payment tools but as the foundational infrastructure of an ecosystem, emphasizing the importance of providing robust developer tools that enable safe and scalable innovation.

Meanwhile, Mr. Heuer pointed out that financial institutions seek use case–specific solutions, highlighting the need to strike a balance between the openness of public chains and strict regulatory compliance — a core dilemma the industry continues to face.

Bridging Fragmentation Through Cross-Chain Connectivity

Mr. Maghnus Mareneck of Cosmos emphasized that as companies and governments develop their own blockchains, there will be a growing need for a common infrastructure that connects them.

He highlighted the importance of interoperability enabled by IBC (Inter-Blockchain Communication).

According to Mareneck, Cosmos is already working with three South American governments to connect their respective national stablecoins via IBC, enabling cross-border payments across national boundaries.

The Importance of Choosing the Right Chain for the Right Purpose

When moderator Mr. Yu Kimura asked the panelists, “What factors will be most important over the next three to five years?”, they responded as follows:

- Mr. Heuer (Aptos): “Interoperability is key. As more stablecoins emerge, speed and reliability will determine success.”

- Mr. Andreoli (Consensys): “As ecosystem fragmentation continues, we need simple systems that users can operate without being aware of complex underlying mechanisms.”

- Mr. Kim (FairSquare Lab): “People continue to use what they’re familiar with. Involvement of financial institutions, such as banks, is essential for adoption, and stronger compliance will be required.”

Although their perspectives seemed different at first glance, a clear common understanding emerged:

“There is no universal blockchain. The optimal chain must be selected according to purpose and use case.”

The speakers also agreed on the importance of evaluating blockchains from four key perspectives — programmability, security, circulation strategy, and economic viability. They noted that future competition will favor chains that specialize in specific domains and can demonstrate clear use cases.

Heuer’s emphasis on interoperability, Andreoli’s focus on simplicity, and Kim’s call for compliance were seen as complementary principles: interoperability requires simplicity in design, and engaging financial institutions demands a solid foundation of regulatory compliance.

This integrated perspective offers valuable insight into solving the multi-dimensional challenges faced by the global blockchain industry. For Japan’s stablecoin market as well, it underscored the importance of understanding international trends and emerging technologies to sustain growth and innovation.

Closing Talk

“This transformation is irreversible — and there is no doubt that stablecoins are at its very center.”

Speaker:

- Daiki Ishikawa, Founder, TOKI FZCO

Wrapping up the event, Mr. Ishikawa, founder of TOKI FZCO, took the stage to deliver the closing address. After introducing TOKI’s solutions for cross-chain asset connectivity and security infrastructure, he offered reflections that captured the essence of the summit.

“The market is shifting from Web3 toward real business use cases. A true transformation has already begun — and standing here today, I can truly feel that momentum.”

With over 750 registrants and more than 300 attendees, the numbers themselves reflected the high level of interest surrounding this theme.

Ishikawa closed with an invitation to action:

“Everyone can take part in this transformation — whether by using blockchain-based applications as a user or by issuing stablecoins as a participant in the ecosystem. The key is to leverage your own strengths to contribute. Together with everyone here today, I hope to accelerate this transformation.”

Symbolizing the beginning of a new chapter for Japan’s stablecoin market, the event concluded with the closing talk and networking session.

Bringing together experts from technology, regulation, and business, the Japan Stablecoin Summit 2025 served as a pivotal step toward shaping the country’s emerging stablecoin ecosystem and financial future.

Partner with Pacific Meta for Blockchain Implementation

If you are interested in utilizing stablecoins or implementing blockchain technology, please contact Pacific Meta.

Pacific Meta provides end-to-end support for everything from new business creation and blockchain system development to marketing and go-to-market strategy.

In the stablecoin domain, we have positioned ourselves as a “testing ground” for the convergence of finance and Web3, actively using stablecoins for asset management and international payments within our own operations.

Leveraging both our hands-on experience and deep technical expertise, we offer comprehensive support covering every aspect — from issuance and management to real-world business integration.

Example Areas of Support

- Stablecoin Implementation: End-to-end support from regulatory compliance to technical deployment

- Blockchain Infrastructure Development: Chain selection and system architecture optimized for your business

- Compliance & Risk Management: Building secure and compliant operational frameworks aligned with financial regulations

- Use Case Development: Planning and implementation of real-world applications such as payments, remittances, and asset management

Our specialized team will propose the most suitable solutions tailored to your business challenges.

If you’re exploring blockchain adoption or stablecoin utilization, we’d be delighted to hear from you.