What is Monad? The $225M Blockchain Project Revolutionizing EVM Compatibility – Features, Architecture, and Market Impact

2024.08.28

- Project Research

- DePIN

Writer

Perhaps the “EVM (Ethereum Virtual Machine)” has been the most powerful narrative in the blockchain market since its inception.

It’s been nearly a decade since the introduction of Solidity, Ethereum’s smart contract language. Throughout this long period, the Ethereum ecosystem has been supported by a large developer community, leading us to where we are today.

The EVM has grown in prominence, responding to the expanding Ethereum ecosystem.

In fact, during the Layer 1 blockchain wars a few years ago, “Is this blockchain EVM compatible?” was one of the important checkpoints, and this trend continues to some extent today.

Pacific Meta also provides a newsletter for companies engaged in Web3 businesses.

Based on the know-how cultivated from supporting over 100 projects, we deliver the latest information on the Web3 industry, case studies of support, and information useful for problem-solving.

➡ Subscribe to Pacific Meta’s newsletter

1. Introduction to Monad

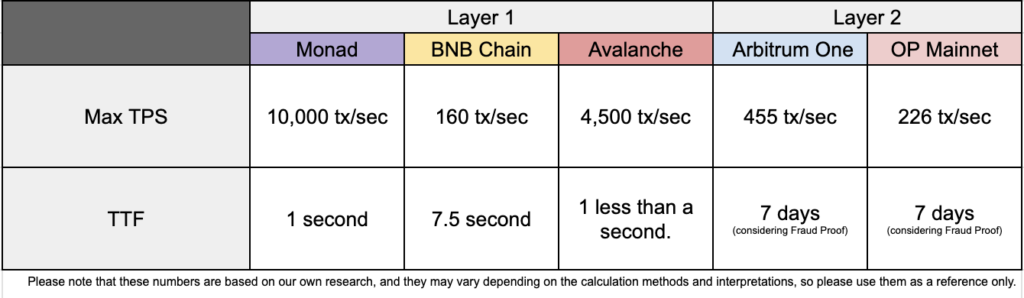

Monad is a next-generation monolithic blockchain that maintains EVM compatibility while offering a throughput of 10,000 TPS and a finality time of 1 second.

While the EVM has been adopted by many blockchains and can provide an attractive environment for existing developers, it has been considered to have limitations in its processing capacity due to its principally single-threaded operation.

Monad has overcome these constraints and achieved parallel transaction processing.

This gives Monad a unique advantage as a blockchain that can immediately accommodate existing Ethereum developers and provide the high performance currently demanded.

In this article, we will aggregate the currently available information about Monad, explain why Monad is attracting attention, and delve into the innovative technology that is the source of this attention.

First, let’s remember the important topics for understanding Monad:

- Massive funding

- Full compatibility with EVM bytecode

- Monad BFT

- Monad DB

Understanding these will help you grasp Monad’s strengths.

2. Team

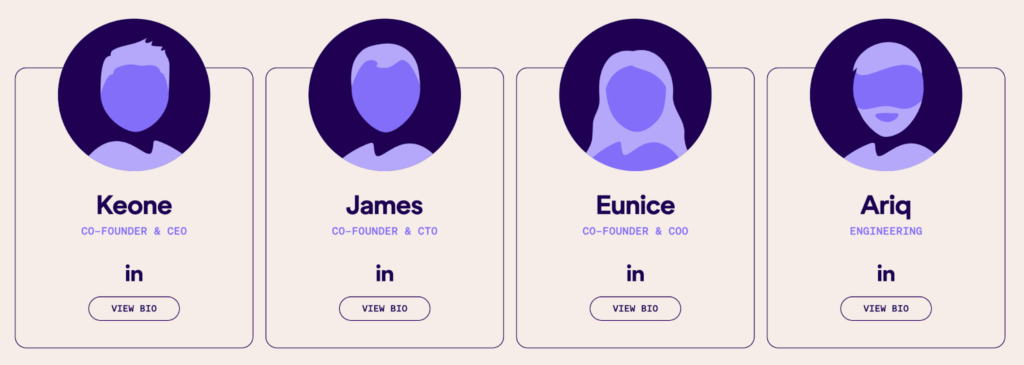

First, let’s introduce the team at Monad Labs, the main development company behind Monad.

Monad Labs was founded in 2022 and started the development of Monad.

The team includes experienced personnel, with the two co-founders coming from Jump Trading, a major market maker.

Co-founder and CEO Keone Hon studied computer science at MIT.

He spent 8 years at Jump Trading developing high-frequency trading (HFT) systems, and from 2020, he led blockchain research and DApp development in the cryptocurrency division.

The other co-founder and CTO, James Hunsaker, studied computer science and mathematics at the University of Iowa. After working as an associate at Goldman Sachs, he served as vice president at J.P. Morgan and Goldman Sachs.

From 2014, he worked on system development as a senior software engineer at Jump Trading.

3. About Funding

Monad is currently attracting attention as the project with the largest funding amount in 2024.

Monad Labs first raised $19 million in a round led by Dragonfly Capital in 2023, and in 2024, they raised $225 million (approximately 34 billion yen) in a round led by the prominent Web3 investment fund Paradigm.

This round included participation from major investors such as Coinbase Ventures, Electric Capital, Greenoaks, and Egirl Capital, as well as individual investors like Mert Mumtaz, CEO of Helius (a Solana RPC node development company), and Rune Christensen, founder of MakerDAO.

The massive funds obtained will be used for Monad’s technological development and ecosystem expansion, with high expectations for the project’s future progress.

Recently, several ecosystem projects have also raised funds, aiming to form a powerful ecosystem.

These investments underscore the trust and expectations for Monad’s network and indicate new technological advancements in the blockchain industry.

4. What is Full EVM Compatibility?

To understand what full EVM compatibility means, we need to know about bytecode.

Bytecode is an intermediate form of code generated when a program’s source code (code written by humans) is compiled.

Ethereum smart contracts are written in a programming language called Solidity, but since virtual machines can only understand bytecode, the source code needs to be compiled into EVM bytecode before it can be executed on the Ethereum network.

Monad’s full EVM bytecode compatibility means that smart contracts running on Ethereum can be executed on Monad without additional changes or recompilation.

This allows the huge Ethereum developer community and rich tools to be utilized directly on Monad. Moreover, full Ethereum RPC compatibility means that Ethereum tools and infrastructure like MetaMask and Etherscan can be used on Monad as they are.

This allows developers to leverage the existing Ethereum ecosystem without the hassle of building new tools and infrastructure.

In other words, DApps that have been successful in the Ethereum ecosystem can quickly migrate to Monad with higher throughput, making it easier to reach new users.

On the other hand, competing monolithic Layer 1 chains like Solana, Sui, and Aptos each require their own programming languages, infrastructure, and tools.

Such environments tend to have high barriers to ecosystem deployment, especially in the early stages of blockchain launch, when support for these elements may be insufficient.

Therefore, EVM compatibility is a very important factor when considering ecosystem growth strategies.

5. What is Monad BFT?

Monad’s scalability primarily stems from its consensus mechanism.

Monad’s consensus mechanism is called “Monad BFT”.

It’s built on existing BFT consensus models like HotStuff and Diem BFT, inheriting their advantages while adding unique improvements.

Incidentally, Aptos also adopts a consensus model based on Diem BFT, and since Monad adopts similar technology, the author had the impression that “Monad = Aptos with EVM compatibility”.

Leader and Round Mechanism

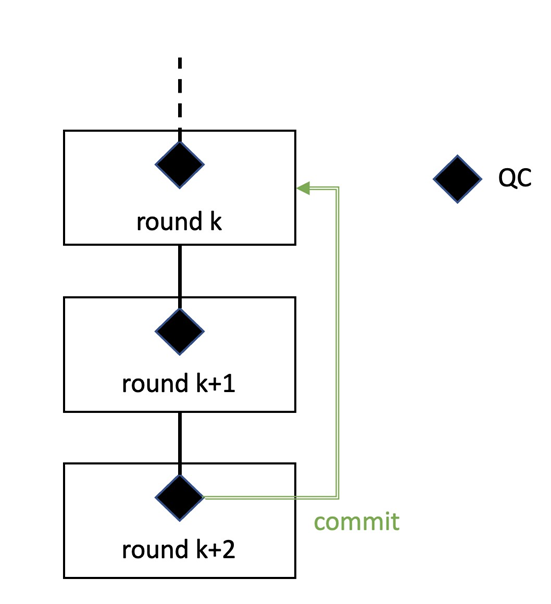

In Monad BFT, like HotStuff and Diem BFT, there are multiple phases called “rounds” to achieve consensus.

Each round is led by a randomly selected leader who proposes a new block. The round progresses as validators vote on this proposal.

In this mechanism, if the block proposed by the leader receives approval from validators representing more than 2/3 of the network stake, a quorum certificate (QC) is issued for that block and it is officially approved.

Rounds are composed of multiple stages, typically progressing with the leader making a proposal and validators returning votes.

However, even if the leader doesn’t make a proposal for some reason or if the proposal times out, additional communication occurs between validators to issue a timeout certificate (TC) and move to the next round.

This allows the system to progress to the next round without stagnation.

While HotStuff, which forms the basis of Monad BFT, adopted a 3-phase round, Monad BFT has simplified this to 2 phases.

This reduces the latency of the consensus process, enabling faster transaction processing.

Shared Mempool

The shared mempool plays an important role in Monad BFT.

The mempool, a combination of “memory” and “pool”, is essentially a temporary storage place for transaction data before it’s added to a block.

Generally, mempools are independent for each validator and need to be communicated and synchronized.

However, in Monad, this mempool has a “gossip protocol” that is shared across the entire network, allowing efficient sharing of transaction data between validators.

This enables all nodes to have the latest transaction information, making efficient consensus possible.

The currently used gossip protocol is planned to transition to a communication method called “Broadcast Tree” in the future for further efficiency.

Pipeline Processing

A major feature of Monad BFT is the adoption of pipeline processing.

Pipeline processing is a technique that conducts the consensus process across multiple rounds, with transaction execution and consensus progressing in parallel.

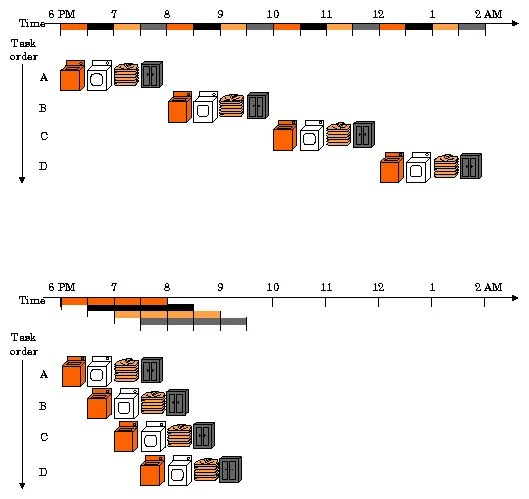

To make it easier to understand, let’s pipeline the laundry process.

Let’s divide the laundry work into four tasks: washing, drying, folding, and storing.

Traditionally, blockchain processes would handle these tasks one by one in order.

However, with Monad’s pipelining, it’s possible to start the next wash as soon as the previous load moves to drying, and to put another load in the dryer as soon as the previous load starts being folded.

The advantage of pipeline processing is that transaction processing in each round can proceed without affecting the next round.

This allows processing in each round to be carried out in parallel, improving overall system efficiency and achieving higher transaction throughput.

Separation of “Execution” and “Consensus”

To enhance pipeline processing, Monad BFT separates the processes of “execution” and “consensus”.

In many traditional blockchains (e.g., Ethereum), when a block is proposed, the transactions within that block are executed, and consensus is formed (block addition) when all validators obtain the same result.

In other words, transaction execution is part of the consensus, and execution takes place before block approval.

On the other hand, in Monad, this process is separated and reversed.

First, consensus is formed on the order of transactions, and then the transactions are executed.

This separation means that transaction execution doesn’t affect the consensus formation of the next block proposal, enabling more efficient pipeline processing.

By separating consensus and execution, each process can progress in parallel, enabling efficient pipeline processing.

This significantly improves blockchain throughput, maximizing throughput.

In other networks, delays in consensus formation affect transaction execution, but in Monad, this risk is mitigated.

However, because execution is postponed in this way, there’s a possibility that it’s not confirmed at the consensus stage whether a transaction is actually valid (for example, whether the sender has sufficient gas fees).

In this case, when trying to execute that transaction later, transactions failing due to insufficient gas may occur frequently, or malicious users may be able to attack the network (DDoS attack) by intentionally sending a large number of transactions with insufficient gas.

If invalid transactions are included in blocks more than expected, the efficiency of the entire network will decrease and resources will be wasted.

To address this concern, the concept of carriage cost, which will be introduced next, was introduced.

Carriage Cost and Reserve Balance

“Carriage Cost” is a new concept related to transaction processing in Monad BFT.

Carriage cost charges a fee for transmitting transactions over the network, separate from the cost of executing the transaction.

This mechanism prevents transactions from being unnecessarily sent even if the account generating the transaction is out of gas, improving the efficiency of the entire network.

Also, to cover the carriage cost, each account has a “Reserve Balance” set.

The reserve balance is a specific fund set to ensure that each account must pay the necessary fees when sending transactions.

This fund is reserved in advance to pay for carriage costs, separate from the account’s overall assets.

This ensures that sufficient carriage cost is secured when transactions are executed, preventing transactions with insufficient gas from being sent to the network.

6. Foundational Technology Supporting Parallel Processing

We’ve explained that pipeline processing is an important point for Monad BFT to achieve parallel processing.

In this section, we’ll dig deeper into this.

To reiterate, pipelining is a technology that divides transaction processing into multiple stages for parallel processing.

However, in an environment where multiple transactions are processed simultaneously, issues of data consistency and conflicts may arise.

This is where STM and OCC play a very important role, as explained next.

STM and OCC

STM (Software Transactional Memory) is a technology that ensures data consistency in parallel processing.

Specifically, when a transaction performs memory operations, it temporarily records those operations and only reflects the changes when it’s confirmed that there are no conflicts with other transactions.

If a conflict occurs, that transaction is re-executed.

An important point of STM is that it proceeds on the premise that there are no data conflicts, rather than proceeding on the premise that data conflicts will occur. This improves the performance of parallel processing.

OCC (Optimistic Concurrency Control) is a technology that adopts an optimistic approach in parallel processing.

In OCC, when transactions are executed simultaneously, it initially assumes that all operations will be performed normally and proceeds with processing.

Then, before the transaction is completed, it checks if any conflicts have occurred, and if there are conflicts, it re-executes.

The advantage of OCC is that it can deliver high performance when conflicts don’t occur.

It might be a bit difficult to understand, but the point is that Monad takes an approach of proceeding with processing on the premise that data conflicts will not occur.

While STM doesn’t assume the possibility of conflicts, OCC has a mechanism to re-execute in case conflicts occur.

It optimistically proceeds to process everything in parallel once, but if conflicting data is confirmed, it re-executes to make things consistent.

This allows the overall processing to be carried out smoothly, maximizing the effect of pipeline processing.

Monad DB

Monad DB is an important database system that supports Monad’s transaction processing.

In particular, it’s characterized by the adoption of asynchronous I/O technology.

I/O operations refer to “Input” and “Output” operations in computer systems, including receiving data, processing it, and sending results externally.

In conventional blockchain database systems, synchronous I/O operations are performed during transaction processing, requiring waiting for data read/write operations to complete before other operations can proceed.

This could constrain overall processing speed.

On the other hand, Monad DB adopts asynchronous I/O, allowing other processes to proceed in parallel without waiting for database I/O operations to complete.

This enables efficient use of CPU resources and minimizes waiting time, improving the overall processing speed of the network.

Furthermore, Monad DB is optimized for high-throughput transaction processing and is designed to maintain data consistency even when multiple transactions access it simultaneously.

This mechanism allows the blockchain network to efficiently process numerous transactions and significantly improve scalability.

7. Considering Monad’s Ecosystem Growth Strategy

Although Monad is still a pre-mainnet launch blockchain, it’s interesting to consider what kind of applications will join and expand its ecosystem.

Monad’s direct competitors are likely to be high-performance chains like Solana, Sui, and Aptos, many of which are non-EVM compatible chains.

These blockchain platforms have already greatly grown their ecosystems, leveraging their first-mover advantage.

For the late-entrant Monad to beat these competitors, the key point will be whether it can leverage its strength of full EVM compatibility.

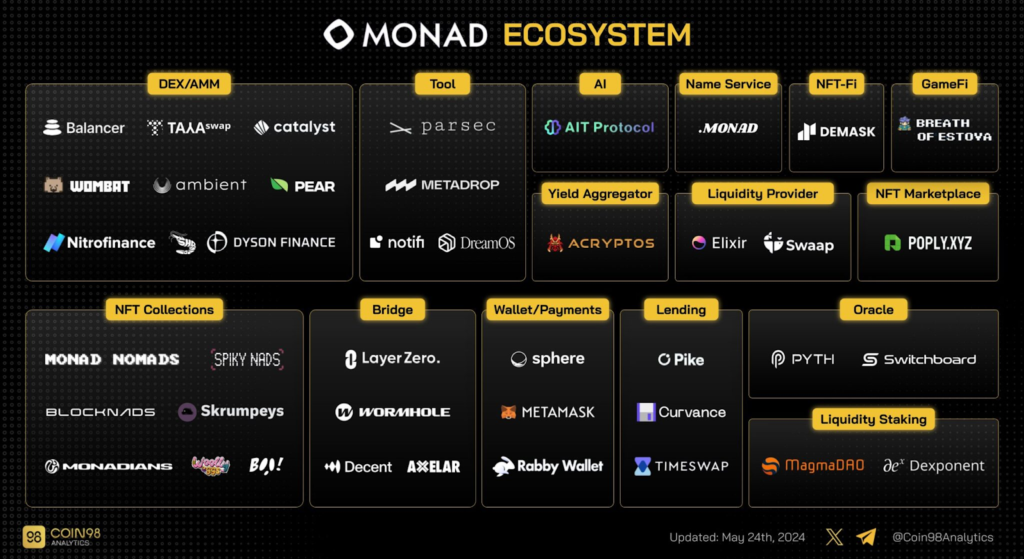

This figure is from May 2024, but already many applications are set to launch on Monad, and it’s expected to become a substantial ecosystem even in its initial stage.

According to Monad’s X post above, they are actively focusing on expanding their ecosystem even before launch.

Indeed, EVM compatibility is still a significant strength in the current Web3 market.

However, even with EVM compatibility, whether Monad can maintain its competitiveness continuously needs further observation.

For Monad to grow significantly, the key will be whether it can continue to actively attract appealing apps and draw promising projects and talent from the Ethereum community in as short a time as possible.

Also, the author believes it’s important to develop applications that leverage Monad’s strengths of high-speed processing and high scalability (such as DEXs capable of high-frequency trading or games requiring real-time performance) to demonstrate uniqueness that other EVM-compatible chains don’t have.

Of course, the Monad team must understand that early ecosystem development will determine Monad’s success.

Recently, they’ve been hosting a 4-week accelerator program and pitch contest by the Monad team, focusing on attracting promising biz-devs and developers.

If they can continue such initiatives in the future, we can expect success for Monad’s future ecosystem.

8. Summary

Monad is attracting attention as a next-generation monolithic blockchain that combines full EVM compatibility with high transaction processing performance.

Its excellent performance and scalability are particularly attractive for applications requiring high-speed processing and projects looking to further expand their multi-chain deployment from the Ethereum ecosystem.

With unique technologies like Monad BFT and Monad DB, it provides an efficient and stable blockchain environment, solving challenges faced by conventional blockchains through the use of parallel processing and asynchronous I/O.

In terms of funding, it has received massive support from major investors, building a strong foundation for ecosystem growth.

Going forward, it’s expected to compete with other high-performance chains using EVM compatibility as a weapon while advancing the development of unique applications.

Particularly, the deployment of applications that can maximize Monad’s performance will be key.

If their active efforts towards ecosystem expansion succeed, Monad could become a significant influence in the blockchain industry.

Additionally, Pacific Meta distributes a newsletter for companies engaged in Web3 business.

Based on the expertise gained from supporting over 100 projects, we deliver the latest information on the Web3 industry, case studies, and other helpful insights to address your challenges.

➡ Subscribe to Pacific Meta’s newsletter

*Disclaimer: This report should not be considered legal or financial advice.